Condo Insurance in and around Minneapolis

Unlock great condo insurance in Minneapolis

Cover your home, wisely

Your Personal Property Needs Coverage—and So Does Your Condo Unit.

As with any home, it's a good plan to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has outstanding coverage options to fit your needs.

Unlock great condo insurance in Minneapolis

Cover your home, wisely

Condo Coverage Options To Fit Your Needs

With this coverage from State Farm, you don't have to be afraid of the unpredictable happening to your biggest asset. Agent Jeff Meyer can help lay out all the various options for you to consider, and will assist you in creating a wonderful policy that's right for you.

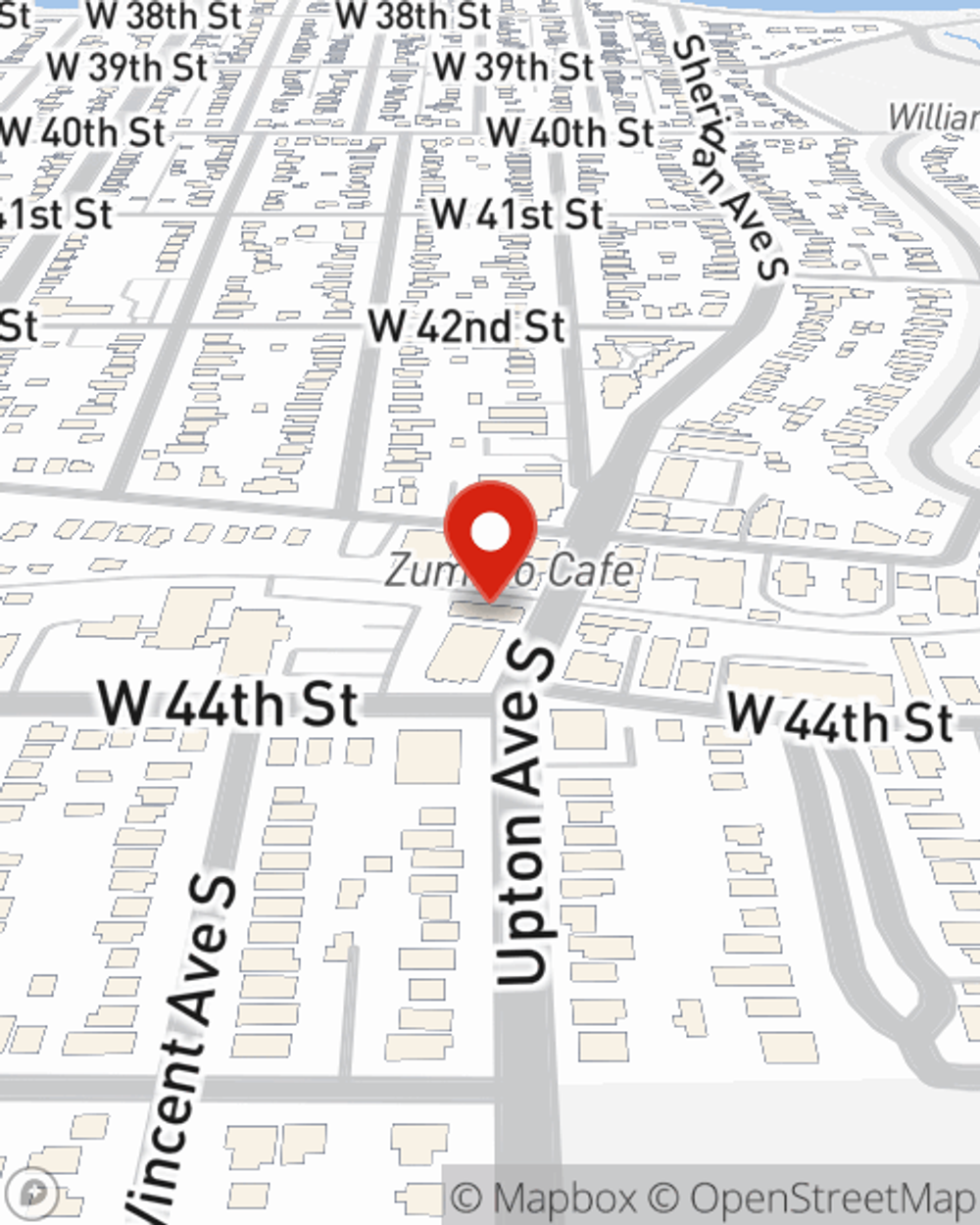

If you're ready to bundle or see more about State Farm's great condo insurance, visit agent Jeff Meyer today!

Have More Questions About Condo Unitowners Insurance?

Call Jeff at (612) 920-2340 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.